From WavePoolMag:

Amid soaring inflation, high-interest rates, crypto meltdowns, and a stumbling stock market, investor confidence is weak, to put it nicely.

Despite falling from its peak in June of 2022, USD inflation still sits at 7%, the highest mark since the 1980s. The current 4.4% interest rate is the highest since the 2008 financial crisis. And 2022 was also the worst year for the stock market in over a decade, with the S&P 500 dropping 20% from its record high.

While no industry will go untouched by the current economic uncertainty, one could imagine that a niche sector like wave pool development would experience a downturn in this climate.

We tested this hypothesis and checked in with industry stakeholders to see how they are faring and after conversations with several players in the wave pool industry, we discovered that the market’s effects are not so cut and dry.

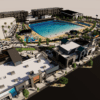

“In some sense, [the market uncertainty] has made us become even more ambitious in our vision,” said Robert Hanson, Creative/Design Director of Surf ATL, which has an Atlanta-area wave pool development in the works. “We were looking at 25 acres, but now we are landing closer to 50, almost the largest size Endless Surf pool that you could have. And, for example, our accommodation plan is going beyond glamping – we are now looking at a possible boutique hotel, vehicle camping, RVs, etc.”

Surf ATL’s Founder Spencer Broome says the current economic climate has pushed the Georgia wave pool project to examine every little detail about their surf park.

“It’s fair to say that we have become more ambitious in determining all avenues for faster ROI due to the market situation,” said Broome. “There are things that are not so vital that you may have to take into consideration from a financial standpoint, from an ROI standpoint. You have to ask yourself, ‘Is this going to help us pay back quicker?’ And you have to balance that with the experience you want to create.”

Stay the Course

Doug Sheres, a Partner of Beach Street, which is developing parks in California, Texas, and other undisclosed locations, didn’t anticipate that the market would alter their overall plan and strategy.

“Surf parks are sensitive to the same things that affect all other developments,” said Sheres. “We use the same labor and materials as other real estate. Every project is different, every budget is different. You adapt your budget and your project to fit your needs.”

The Real Threat Has Been Material Costs

Ryder Thomas, a Partner of the surf park advisory firm Pro Swell thinks that the interest rates and inflation haven’t had the critical impact that one might speculate.

“We haven’t seen tremendous disruption in the industry from inflation or interest rates,” said Thomas. “And by “tremendous disruption” I mean projects blowing up as a consequence.”

“With respect to inflation, the reality is that the entire development industry was essentially run over by the surge in building material costs during the pandemic,” he added. “We have absolutely seen the surge in materials costs impacting the price of construction and consequently the viability of certain pools/pool types.”

Thomas has his theories for why the surf park sector has been able to absorb the effects of high interest rates.

“To date, leverage ratios have been low, or nonexistent, as early [wave pool] projects are relying on deep-pocketed sponsors/developers who have the means to tackle projects on an all-equity basis,” said Thomas.

Will High Interest Rates Kill Upcoming Projects?

Baptiste Caulonque, Chief Commercial Officer of Endless Surf says that he’s yet to see inflation or interest rates impact the space. He says there is extra scrutiny because of these indicators, but it has yet to cause any of their potential clients to back off.

“The reality is that the financial performance of most envisaged projects is robust enough to support these negative trends,” added Caulonque. “And most projects are very equity intensive, so the cost of debt today is not as critical since these investors will look to refinance one-to-two years into operations. By then the interest rates will be different.”

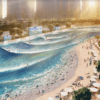

For an extreme example of how high-interest rates and economic uncertainty can affect the strategy of surf parks, look at the private surf parks that have been proliferating in Brazil. High-interest rates have incentivized real estate models; That is, pools are tacked onto a bigger development project, which avoids the need for the pool to turn a profit via ticket sales and speeds up the time it takes to recoup investment via income from property sales.

“We have very high interest rates in Brazil,” said Oscar Seagall, CEO of KSM Realty, which developed the Wavegarden pool Praia da Grama in São Paulo. “When you put 100% of the equity first [into a development project], the returns are being penalized by carrying this equity that is exposed. As you reduce the equity exposed on the business model [with the real estate strategy], there is less stress on the equity.”

The Funding to Build Wave Pools is Increasing

According to Dr. Jess Ponting, the Founder & Director of San Diego State University’s Center for Surf Research, wave pools are reaching milestones by accessing newly-found institutional capital. He cited several examples of the space being flush with cash.

“2022 was the year that the [wave pool] industry busted down the door of banks and pension funds,” said Ponting in an email. “In the first instance what was formerly Wavegarden Scotland and is now Lost Shore Surf Resort secured eight-figure loans from the Scottish National Investment Bank, UK based OakNorth Bank, and the pension fund of BAE Systems, a defense contractor. Since then KSM Realty in Brazil has partnered with BTG Pactual Asset Management who invest and manage assets on behalf of institutional capital to build a giant surf park, called Beyond the Club in Sao Paulo. We may look back on these developments as the projects that opened the institutional capital floodgates for the surf park industry.”

On the other hand, Broome of Surf ATL acknowledges some uncertainty as to where future funding will come from.

“From an equity perspective it’s tougher to get people to open their purse strings with a murky financial forecast,” said Broome. “[Capital] is not just from individual investors, it’s family offices, investment groups, etc. In our past experience, we could find investors based on their passion for surfing and the culture, but with market effects, we have to ensure it is a great business opportunity outside of a passion for surfing.”

The Economic Climate’s Impact on the Wave Technology Companies

Thomas of Pro Swell believes there will be tangible effects on the wave pool industry that will manifest as a result of the current financial markets.

“It becomes very difficult to justify building a surf pool when construction costs tick over a certain threshold,” said Thomas. “I can think of numerous examples in which one technology provider was switched out for another or the pool model was dialed back based on estimated costs.”

“My opinion is that this is going to impact certain [wave pool] technology providers more than others,” Thomas concluded. “I think the battle lines in the technology space need to be waged around building a facility with the smallest possible horizontal footprint, thereby decreasing materials costs and increasing site area available for vertical development and alternative revenue streams.”

You must be logged in to post a comment Login